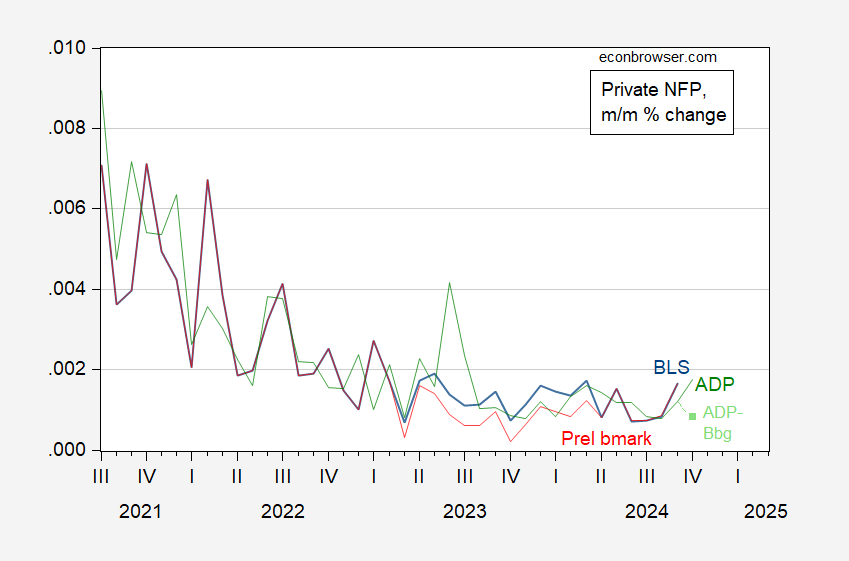

GDP under Bloomberg consensus of 3.0% at 2.8% (GDPNow nails it). ADP private NFP change at 233K vs. Bloomberg consensus at 110K.

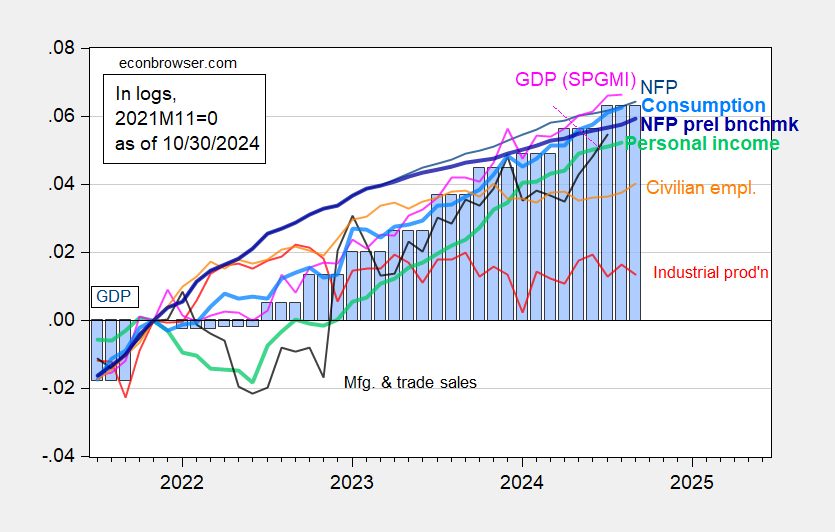

Figure 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q3 1st release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (10/1/2024 release), and author’s calculations.

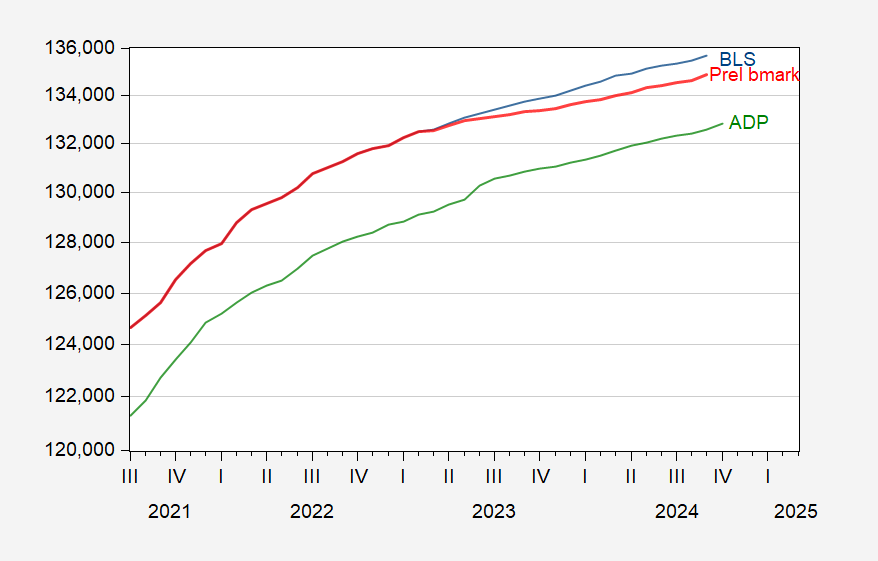

Figure 2: Private nonfarm payroll employment from BLS (blue), implied preliminary benchmark revision of private NFP from BLS (red), and ADP-Stanford Digital Economy Lab private nonfarm payroll employment (green), all in 000’s. Source: BLS, ADP via FRED, and author’s calculations.

Recall, the ADP numbers are not based on a survey (so no issues about the firm birth-death model output, etc.).

Figure 3: Month-on-Month growth rate of Private nonfarm payroll employment from BLS (blue), implied preliminary benchmark revision of private NFP from BLS (red), and ADP-Stanford Digital Economy Lab private nonfarm payroll employment (green), and Bloomberg consensus (light green square), all calculated using log differences. Source: BLS, ADP via FRED, Bloomberg, and author’s calculations.

Contra EJ Antoni, Kevin Hassett, Larry Kudlow, Peter Thiel, and Wilbur Ross these don’t look like recession numbers to me. However, we get personal income and consumption for September tomorrow, as well as manufacturing and trade industries sales for August.