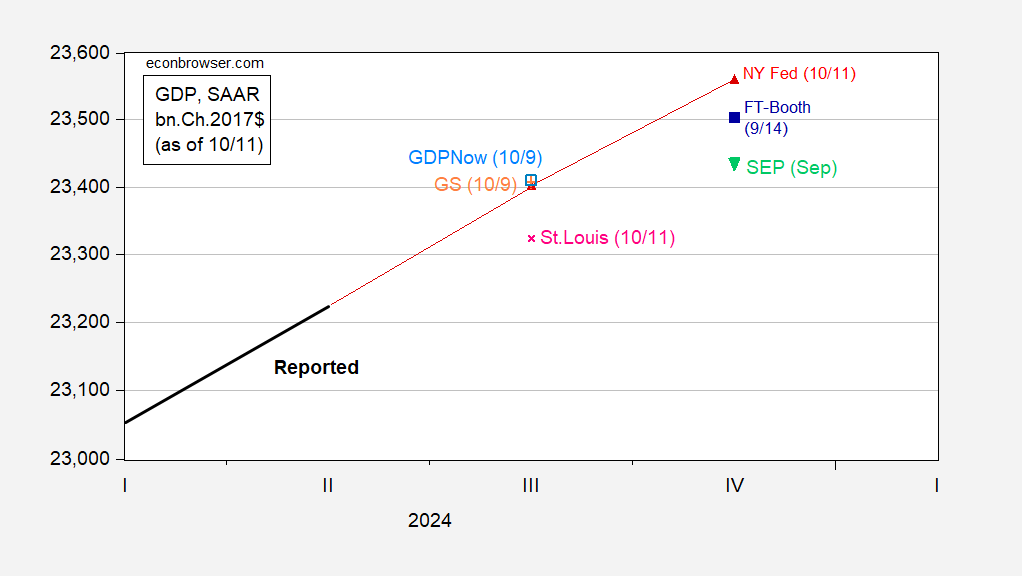

Nowcasts for NY and St. Louis Feds out today; St. Louis up from 1.14% to 1.73% q/q AR. NY Fed, and GS tracking unchanged at 3.2%.

Figure 1: GDP (bold black), Summary of Economic Projections median iterated off of 3rd release (inverted light green triangle), GDPNow as of 10/9 (light blue square), NY Fed nowcast as of 10/11 (red triangles), St Louis Fed news nowcast as of 10/11 (pink x), Goldman Sachs tracking as of 10/9 (green +), FT-Booth as of 9/14 iterated off of 3rd release (blue square), all in bn.Ch.2017$ SAAR. Levels calculated by iterating growth rate on levels of GDP, except for Survey of Professional Forecasters. Source: BEA 2024Q2 3rd release, Atlanta Fed, NY Fed, Philadelphia Fed, Federal Reserve September 2024 SEP and author’s calculations.

The Lewis-Merten-Stock Weekly Economic Index (for data available through 10/5) is at 2.10% AR, while the corresponding Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index is at -0.11% (so 1.89% if 2% is trend). Hard to see a recession in data available through early October, then.

Finally, with these estimates out, I welcome a new member to the “recession camp”: Mike Shedlock. In addition, EJ Antoni and Peter St. Onge have backdated the recession’s start to 2022.