Business Cycle Indicators as of November’s Start

Employment for October and monthly GDP for September, in the set of variables followed by the NBER’s BCDC:

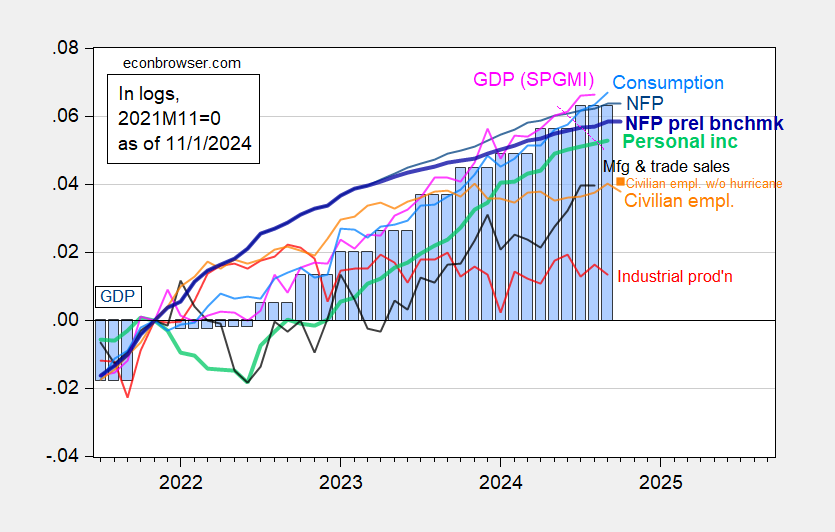

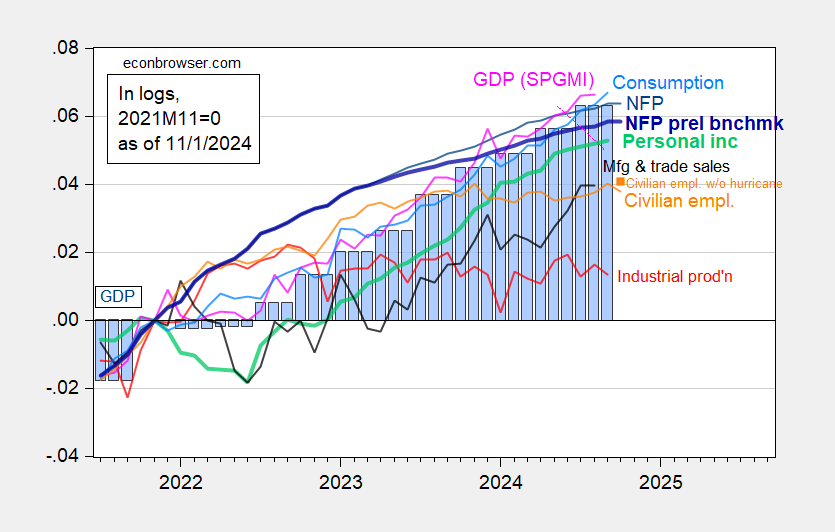

Figure 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (bold blue), civilian employment (orange), civilian employment adding number of workers indicating unemployed due to weather (orange square), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q3 1st release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (11/1/2024 release), and author’s calculations.

Note that adding in 41K for the strikes will not change the path much for reported NFP; however adding in 460K for the decrease d employment due to bad weather makes the household survey series (civilian employment, see orange square) look less daunting.

Available alternative indicators are generally up, including the coincident index for September, and vehicle miles traveled (VMT) for August.

Figure 2: Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted using CBO immigration estimates through mid-2024 (orange), manufacturing production (red), personal income excluding current transfers in Ch.2017$ (light green), retail sales in 1999M12$ (black), vehicle miles traveled (VMT) (chartreuse), and coincident index (pink), GDO (blue bars), all log normalized to 2021M11=0. Early benchmark is official NFP adjusted by ratio of early benchmark sum-of-states to CES sum of states. Source: Philadelphia Fed, Federal Reserve via FRED, BEA 2024Q2 third release/annual update, and author’s calculations.

High frequency (weekly) indicators are mixed, with the Lewis-Mertens-Stock WEI at 2.1%, and the Baumeister-Leiva-Leon-Sims WECI at 1.5% (assuming trend is 2%).

Figure 3: Lewis-Mertens-Stock Weekly Economic Index (blue), and Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (tan), all y/y growth rate in %. Source: NY Fed via FRED, WECI, accessed 11/1/2024, and author’s calculations.

GDPNow for Q4 is at 2.3% today; NY Fed nowcast at 2.01%.

Recent Posts

Nintendo Switch 2: Everything we know after the Direct announcement

With Nintendo's April 2 Direct showcase over and done, we now know more about the…

2 April 2025: An Event Study

Odds of a recession in 2025: Source: Kalshi, 2 April 2025, 8pm CT. Polymarket confirms:…

Gen Z’s Bitcoin Bet, The Largest Wealth Transfer In History?

Episode Summary On this episode of Bitcoin Backstage, Isabella Santos mines deep on the looming…

Americans will ‘feel the pinch quite quickly’ on Trump tariffs

US President Donald Trump holds a signed executive order after delivering remarks on reciprocal tariffs…

The Czech Republic, and its quiet automotive giant Skoda, are bucking an economic downturn unfolding in its crucial ally Germany

There is a shadow hanging over the Europe. The ascent of Donald Trump to the…

The best retro games console is the one you played at age 10

The Nintendo game Super Mario Advance, a version of Super Mario Bros compatible with a…